Understanding Personal Loan Terms

Introduction to Personal Loans

Personal loans can be a practical solution for those seeking to manage financial needs, whether it’s consolidating debt, covering unexpected expenses, or financing a major purchase. Unlike secured loans, personal loans do not require collateral, making them accessible to many who might not have assets to pledge. This article delves into the intricacies of personal loans, examining their benefits and drawbacks, and what potential borrowers should anticipate.

Pros of Personal Loans

Personal loans offer several advantages that make them a viable option for many borrowers. One of the primary benefits is flexibility. Borrowers can use the funds for a variety of purposes, from home renovations to medical bills. Additionally, personal loans often come with fixed interest rates, ensuring stable monthly payments, which can be easier to manage within a budget.

Another significant advantage is the relatively quick approval and disbursement process compared to other types of loans. This can be particularly beneficial in emergencies where immediate funds are required. Furthermore, personal loans can help improve credit scores when managed responsibly. Regular, on-time payments contribute positively to credit history, which is crucial for future borrowing.

- Flexibility in fund usage

- Fixed interest rates

- Quick approval process

- Potential for credit score improvement

Cons of Personal Loans

While personal loans have their benefits, they also come with certain disadvantages. One of the main drawbacks is the higher interest rates compared to secured loans. Since personal loans are unsecured, lenders often charge higher rates to compensate for the increased risk. This can lead to higher overall costs over the life of the loan.

Additionally, fees such as origination fees, late payment fees, and prepayment penalties can add to the cost. Borrowers should carefully read the terms to avoid unexpected charges. Moreover, failing to make timely payments can negatively impact credit scores, making it harder to secure future loans.

- Higher interest rates compared to secured loans

- Potential additional fees

- Impact on credit score if not managed properly

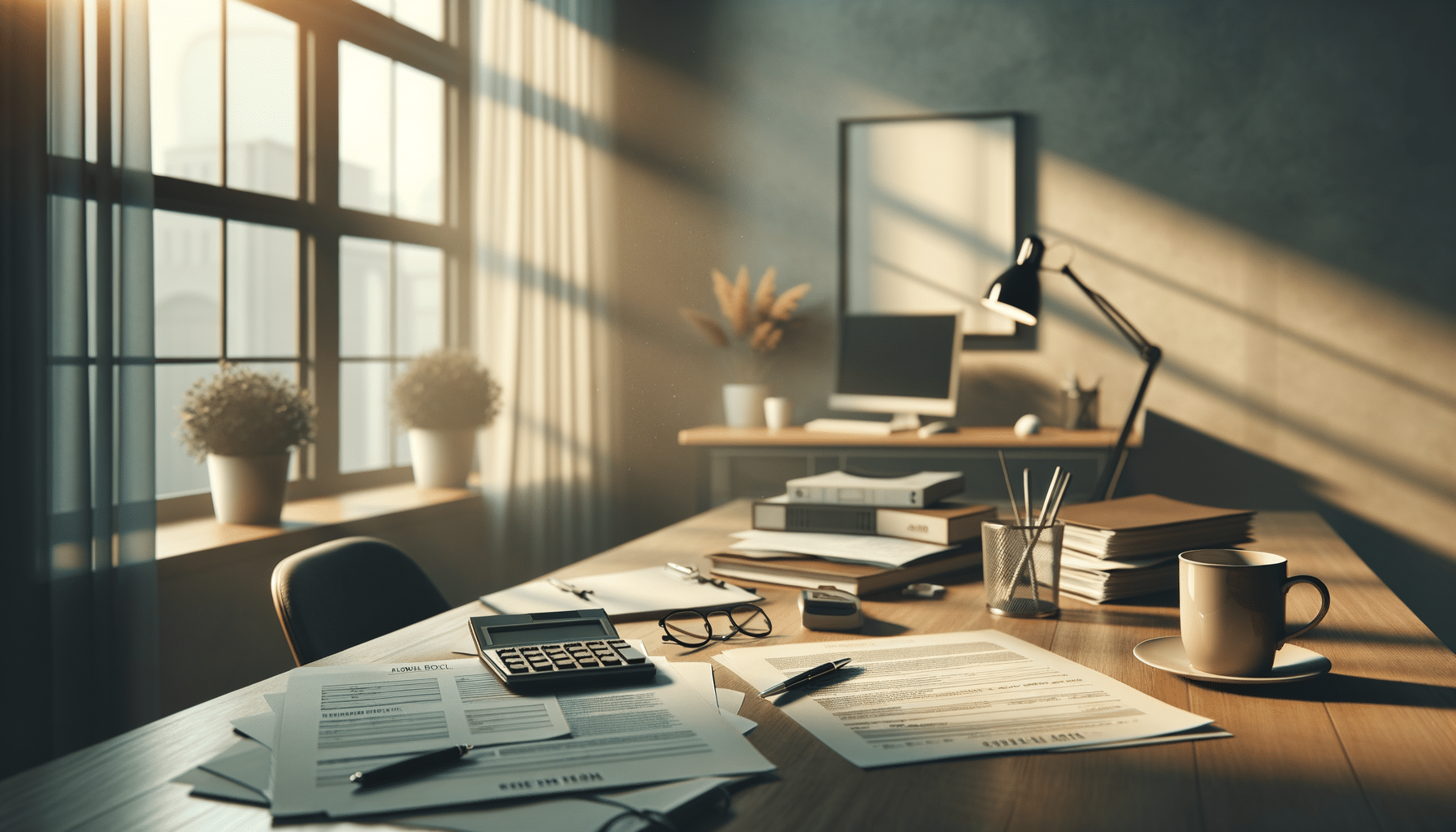

What to Expect When Applying for a Personal Loan

Before applying for a personal loan, it’s essential to understand the requirements and process. Lenders typically assess credit scores, income, and debt-to-income ratios to determine eligibility. A higher credit score often results in more favorable terms, including lower interest rates.

Potential borrowers should prepare to provide personal and financial information, such as proof of income and identification. It’s advisable to compare offers from multiple lenders to find the most suitable terms. Understanding the loan agreement, including interest rates, fees, and repayment terms, is crucial to avoid future financial strain.

By being informed and prepared, borrowers can make better decisions that align with their financial goals.

Conclusion: Making Informed Decisions

Personal loans can be a valuable tool for managing financial needs, but it’s vital to weigh their pros and cons carefully. Understanding the terms and conditions, as well as the potential impact on your financial health, is crucial. By approaching personal loans with a clear plan and realistic expectations, borrowers can utilize them effectively to achieve their financial objectives.