Mastering Advanced Candlestick Patterns: A Guide for Experienced Traders

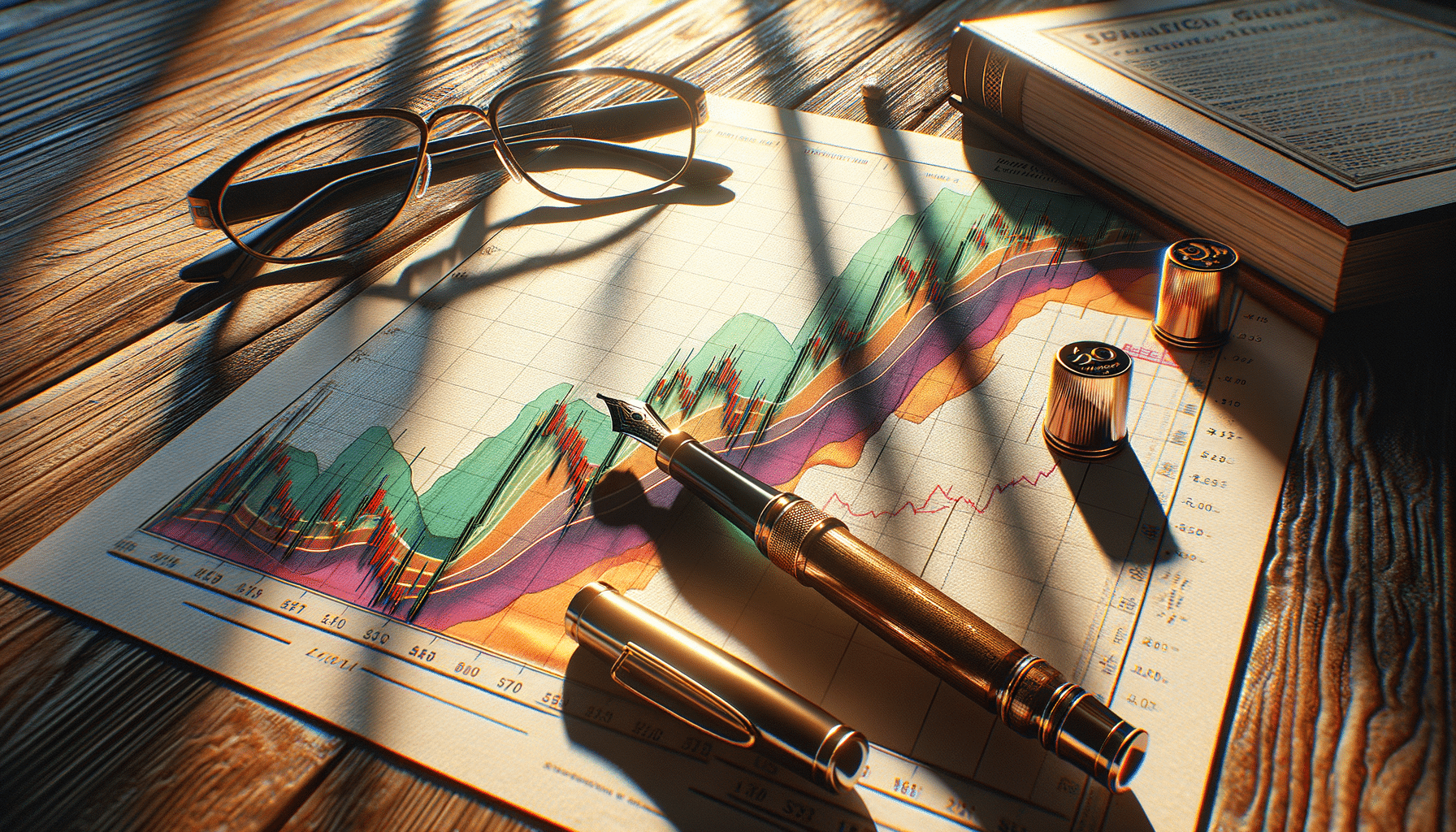

Introduction to Advanced Candlestick Patterns

In the world of trading, understanding chart patterns is crucial for making informed decisions. Among the various tools available, candlestick patterns offer a visual representation of market sentiment. While basic patterns provide a foundation, advanced candlestick patterns are essential for experienced traders seeking to refine their strategies. These patterns reveal more complex market dynamics, offering insights into potential price movements. In this article, we delve into these sophisticated patterns, illustrating their importance and relevance in modern trading.

Engulfing Patterns: A Closer Look

Engulfing patterns are among the most recognized candlestick formations. They occur when a larger candle completely envelops the smaller one from the previous session, signaling potential reversals. The two main types are the bullish engulfing pattern and the bearish engulfing pattern.

The bullish engulfing pattern appears at the end of a downtrend, suggesting a possible upward reversal. It indicates that buyers have taken control, overpowering the sellers. Conversely, the bearish engulfing pattern surfaces at the peak of an uptrend, hinting at a downward reversal. It signifies that sellers have gained the upper hand.

Traders often use these patterns in conjunction with other indicators to confirm their predictions. For instance, combining engulfing patterns with volume analysis can enhance accuracy. A significant volume increase during the formation of an engulfing pattern typically strengthens the reversal signal.

- Bullish Engulfing: Signals upward reversal.

- Bearish Engulfing: Indicates potential downward trend.

Exploring the Harami Pattern

The Harami pattern is another advanced candlestick formation that traders should recognize. It consists of two candles, where the second one is smaller and contained within the body of the first. This pattern can indicate a potential reversal or continuation, depending on the context.

A bullish Harami appears during a downtrend, suggesting a possible reversal to the upside. It indicates indecision among traders, as the momentum shifts from sellers to buyers. On the other hand, a bearish Harami occurs during an uptrend, hinting at a potential reversal to the downside. It reflects a weakening of the bullish momentum.

Traders should pay attention to the volume and the location of the Harami pattern within the trend. A Harami pattern at key support or resistance levels can be particularly significant, reinforcing the potential reversal signal.

- Bullish Harami: Possible reversal in downtrend.

- Bearish Harami: Potential reversal in uptrend.

Understanding the Doji Patterns

Doji patterns are characterized by their unique shape, where the opening and closing prices are nearly identical, forming a thin or nonexistent body. These patterns represent indecision in the market and can precede significant price movements.

There are several types of Doji patterns, including the standard Doji, the long-legged Doji, and the dragonfly and gravestone Doji. Each type has its implications depending on the context in which it appears. For example, a standard Doji during an uptrend might indicate a potential reversal, as buyers and sellers reach an equilibrium.

Traders often use Doji patterns to signal a pause in the current trend, prompting them to look for additional confirmations before making trading decisions. The position of the Doji within the trend and the subsequent candlestick formations can provide valuable insights into future price movements.

- Standard Doji: Signals indecision.

- Long-legged Doji: Indicates potential reversal.

- Dragonfly/Gravestone Doji: Suggests market equilibrium.

Conclusion: The Value of Advanced Patterns

Advanced candlestick patterns offer experienced traders a deeper understanding of market dynamics. By mastering these patterns, traders can enhance their analytical skills and improve their decision-making processes. Whether it’s the engulfing pattern, Harami, or Doji, each formation provides unique insights into potential market movements. As traders continue to hone their skills, incorporating these advanced patterns into their strategies can lead to a more comprehensive approach to trading. Remember, while candlestick patterns are powerful tools, they are most effective when used alongside other technical indicators and market analysis techniques.