Learn the Strategies That Top Traders Use

Introduction to Online Trading Bootcamps

In the fast-paced world of financial markets, learning effective trading strategies is crucial for success. Online bootcamps have emerged as a popular and effective way to acquire these skills. These programs offer structured, intensive training designed to equip participants with the knowledge and tools needed to navigate the complexities of trading. By participating in these bootcamps, aspiring traders can gain insights into market analysis, risk management, and strategy development, making them better prepared to face the challenges of the trading world.

Online trading bootcamps provide a flexible learning environment, allowing participants to engage from anywhere in the world. This accessibility is especially beneficial for those balancing other commitments, as it offers the opportunity to learn at one’s own pace. Moreover, these programs often bring together a diverse group of participants, fostering a community of learners who can share experiences and insights, further enhancing the educational experience.

These bootcamps typically cover a wide range of topics, from the basics of trading to advanced strategies used by successful traders. Participants can expect to delve into areas such as technical analysis, fundamental analysis, and trading psychology. The comprehensive nature of these programs ensures that learners are well-rounded in their understanding and application of trading principles.

Understanding Key Trading Strategies

Trading strategies form the backbone of any successful trading endeavor. They provide a systematic approach to making trading decisions, helping traders manage risk and maximize potential returns. Among the most popular strategies covered in online bootcamps are trend following, mean reversion, and breakout strategies.

Trend following involves identifying and capitalizing on the momentum of a market trend. Traders using this strategy look for securities that are trending in a particular direction and aim to ride the wave until signs of a reversal appear. This strategy is grounded in the belief that markets tend to move in sustained trends, and identifying these can lead to profitable opportunities.

Mean reversion, on the other hand, is based on the premise that prices will eventually return to their historical average. Traders employing this strategy look for price deviations from the norm and trade on the expectation that prices will revert back. This can be particularly effective in markets that exhibit cyclical behavior.

Breakout strategies focus on identifying key levels of support and resistance. When a price breaks through these levels, it is often seen as an indicator of strong directional movement. Traders using breakout strategies aim to enter trades at these critical junctures, capitalizing on the increased volatility and momentum.

Important Considerations for Successful Trading Strategies

While learning trading strategies is essential, understanding the considerations that underpin successful execution is equally important. Key factors include risk management, emotional discipline, and continuous learning.

Risk management is the cornerstone of successful trading. It involves setting clear risk parameters and adhering to them strictly to prevent significant losses. This can include setting stop-loss orders, diversifying portfolios, and maintaining a risk-reward ratio that aligns with one’s trading goals.

Emotional discipline is another critical aspect. Trading can be emotionally taxing, with markets often exhibiting volatility that can test a trader’s resolve. Maintaining a calm and rational mindset, regardless of market conditions, is essential for making sound decisions and avoiding impulsive actions that can lead to losses.

Continuous learning is a hallmark of successful traders. Markets are dynamic, and staying informed about new developments, tools, and strategies is crucial. This includes analyzing past trades to identify strengths and weaknesses and adapting strategies accordingly.

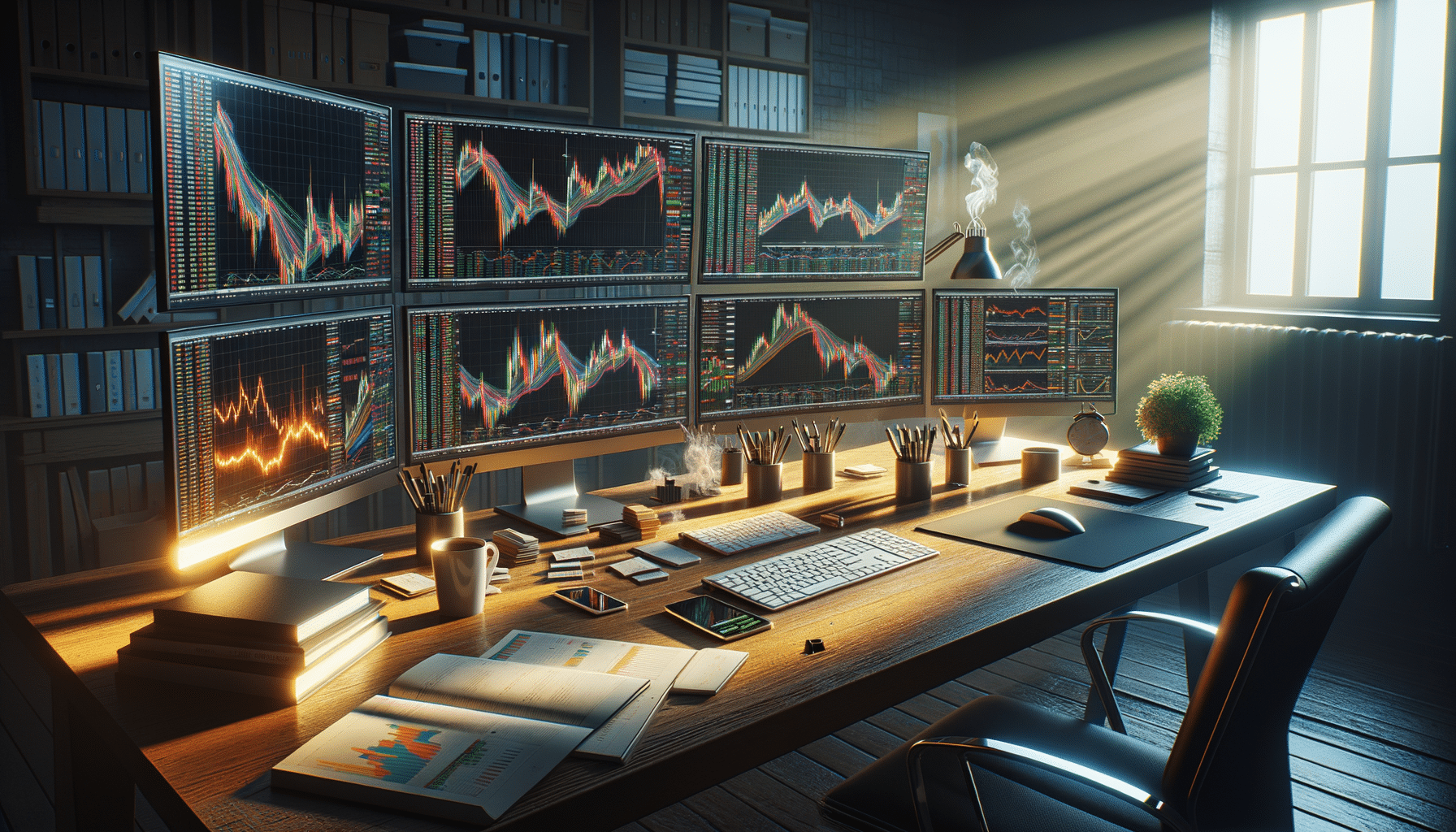

The Role of Technology in Modern Trading Strategies

Technology plays a pivotal role in modern trading, providing traders with tools and platforms that enhance their ability to execute strategies effectively. From algorithmic trading to advanced charting software, technology has transformed the trading landscape, making it more accessible and efficient.

Algorithmic trading, for instance, uses computer programs to execute trades based on predefined criteria. This allows for faster and more accurate trade execution, minimizing the potential for human error. Algorithms can analyze vast amounts of data in real time, identifying patterns and opportunities that might be missed by manual analysis.

Advanced charting software offers traders a visual representation of market data, facilitating technical analysis. These tools provide a range of indicators and overlays that help traders identify trends, patterns, and potential entry and exit points. The ability to customize charts and indicators to suit individual trading styles enhances the effectiveness of these tools.

Moreover, technology has democratized access to financial markets, enabling retail traders to participate alongside institutional players. Online trading platforms provide real-time data, news, and analysis, empowering traders to make informed decisions and execute trades efficiently.

Conclusion: Empowering Traders Through Education

In conclusion, learning trading strategies through online bootcamps offers a valuable opportunity for aspiring traders to develop the skills and knowledge needed to succeed in the financial markets. These programs provide a comprehensive education, covering key strategies and considerations that are essential for navigating the complexities of trading.

By understanding and applying effective trading strategies, participants can improve their chances of success and achieve their financial goals. The integration of technology further enhances this process, offering tools and platforms that streamline and improve trading efficiency.

Ultimately, the combination of education, strategy, and technology empowers traders to navigate the ever-evolving landscape of financial markets with confidence and competence.