Downsizing in Retirement: What People Often Consider

Introduction and Outline

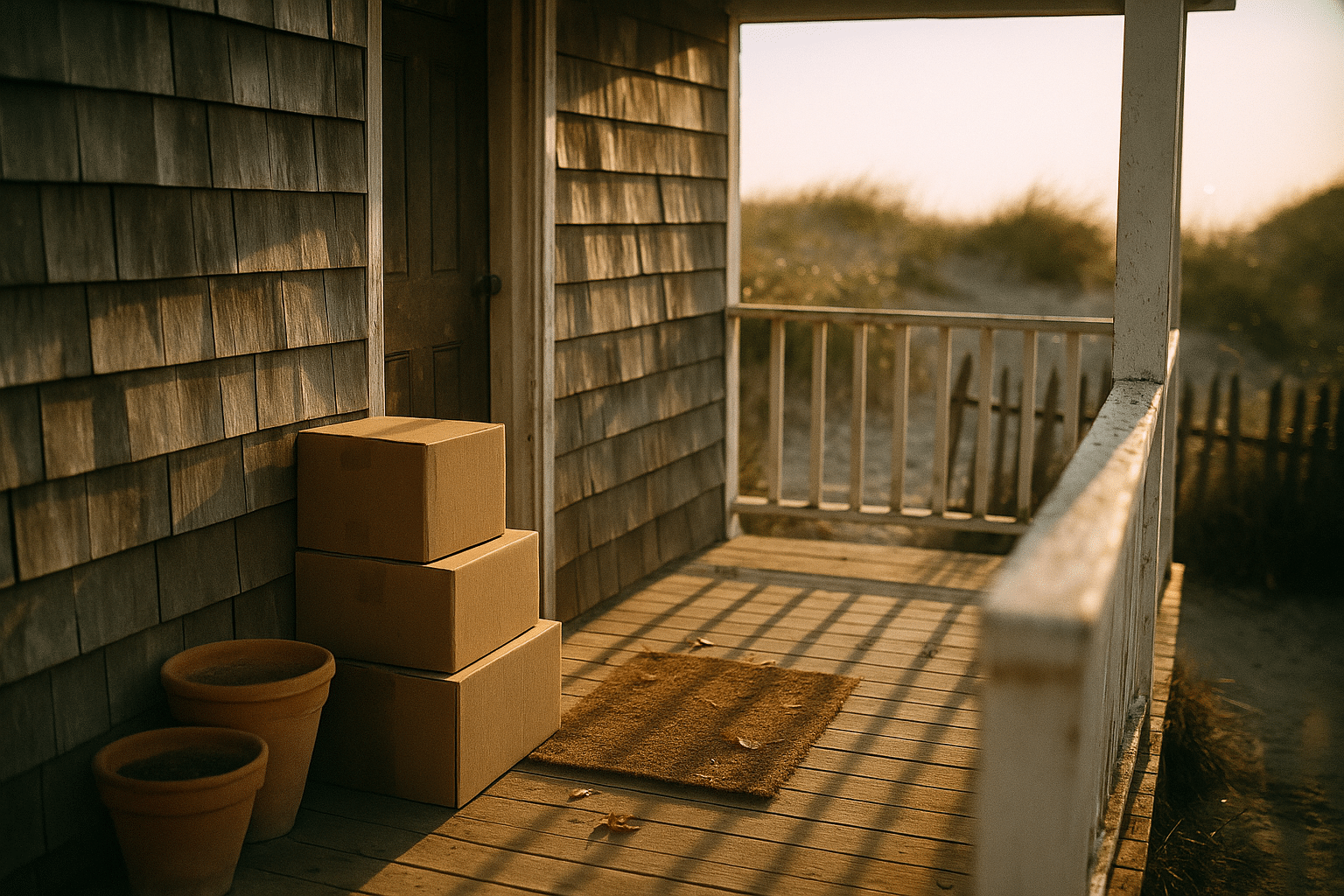

For many people approaching retirement, the home begins to feel like a question rather than an answer. Rooms that once hosted science projects and birthday banners sit quiet, while the lawn continues to grow and the tax bill arrives like clockwork. Downsizing is not only about shrinking square footage; it is about expanding flexibility: less upkeep, more time, and a budget that bends instead of breaks. As lifespans lengthen and households change, housing choices shape quality of life more than almost any other decision. That’s why this guide looks past glossy slogans and into practical numbers, real trade-offs, and the very human feelings that surface when a house becomes a chapter you’re ready to close.

Before diving in, here is a simple outline to keep you oriented as you read:

– Why people consider downsizing in retirement: financial, lifestyle, and health motives

– Space, upkeep, and location: how the daily realities of a smaller place differ

– The emotional side: leaving, arriving, and adjusting with intention

– A practical path: comparisons, checklists, and steps to move with confidence

What makes downsizing relevant now? Housing costs have outpaced many fixed incomes, maintenance trades are in high demand, and neighborhoods continue to evolve. At the same time, access to care, walkable amenities, and social connection are increasingly important. Shifting to a home that fits the next decade—rather than the last—can free cash flow, reduce risk, and open time for pursuits that matter: grandkids, volunteering, learning, or quiet mornings with the paper and a warm mug. Think of this as a field guide: part map, part compass, designed to help you navigate with clear eyes and calm steps.

Why People Consider Downsizing in Retirement

Three motives show up again and again in conversations about downsizing: financial resilience, lifestyle design, and health planning. On the financial side, older households devote a meaningful share of their spending to housing. Consumer expenditure data regularly show housing near the top of the budget for retirees, often approaching a third of annual outlays when you include property taxes, insurance, utilities, and maintenance. That level of fixed expense can strain a portfolio during volatile markets or when unexpected medical costs arise. Downsizing can reduce these obligations and release equity to strengthen an emergency fund or generate investment income.

Consider a simple scenario: selling a $500,000 house and buying a $350,000 condo. The move may free $150,000 in equity before transaction costs, lower annual property taxes, and reduce homeowners insurance. Ongoing expenses shift, too. The “1% rule” for maintenance suggests many single-family homes consume roughly 1% of their value annually in upkeep, while a smaller, newer place may require far less hands-on work. Utilities typically follow square footage: heating, cooling, and lighting a smaller footprint can trim monthly bills. Even after adding a monthly community fee for amenities and exterior maintenance, the net can favor the downsizer—especially when you include the value of time saved from yard work and repairs.

Lifestyle design matters just as much. Retirees frequently cite a wish to travel longer, host shorter, and spend fewer weekends waiting for a delivery window or repainting trim. A home that is easy to lock and leave brings peace of mind. Proximity to a library, park, or local café can turn errands into social rituals, while single-level living reduces the friction of stairs and heavy lifting. Reduced household complexity also cuts decision fatigue: fewer rooms to furnish, fewer things to break, fewer chores to schedule.

Health planning sits quietly underneath the other motives. As mobility changes, so do thresholds, tubs, and laundry on the second floor. Features like step-free entries, wider hallways, and walk-in showers can prevent falls and support independence. Access to public transit and nearby medical offices reduces reliance on long drives. Taken together, these reasons explain why many people view downsizing not as a retreat, but as a strategic shift—trading square footage for stability, access, and time.

Space, Upkeep, and Location: What Really Changes

Downsizing reshapes daily rhythms. Space influences how you move, what you keep, and how you host. In a smaller home, storage becomes a curated gallery rather than a basement archive. That pushes clarity: which tools do you use monthly, which heirlooms tell a story, which duplicates can be gifted? Fewer rooms also concentrate life into bright, active zones. Kitchens see more light and conversation; unused bedrooms stop collecting half-finished projects. Cleaning time falls: two to three hours a week for a compact home versus double that for a large, multi-level property is a common experience.

Upkeep is where many people feel the immediate difference. Exterior maintenance—roofing, gutters, siding, snow removal—either shrinks or shifts to an association that handles the heavy lifting. The trade-off is predictable: you exchange irregular, sometimes large, repair bills for regular community fees. For many, that’s a welcome swap. Interior maintenance also changes. Smaller spaces mean shorter lists: fewer windows to seal, less carpet to steam, fewer fixtures to service. The energy footprint contracts as well. Heating and cooling costs commonly track square footage and insulation quality; a smaller, well-sealed home can lower utility use meaningfully, especially in regions with harsh winters or hot summers.

Location ties all of this together. A home closer to daily needs can save hours each week and reduce transportation costs. Walkable neighborhoods encourage movement and spontaneous social contact, which supports physical and mental health. Proximity to clinics and grocery stores trims the stress of scheduling. There are trade-offs to weigh. Community fees may be higher in amenity-rich areas. Property taxes vary widely by municipality. Noise levels can rise closer to town centers, while rural locations deliver quiet at the cost of longer drives. Climate risk matters, too: coastal charm can come with storm seasons and insurance considerations; arid regions may offer low yard work but require attention to heat.

When comparing options, sketch the differences clearly:

– Square footage and layout: single-level vs. multi-level, number of steps, storage access

– Fixed costs: property tax, insurance, community fees, average utilities

– Variable costs: repairs, maintenance frequency, transportation

– Access: healthcare, groceries, parks, transit, social hubs

– Everyday friction: parking, noise, stairs, snow, summer heat

The right combination is rarely about smallest or cheapest; it is about fit. A home that matches your habits and priorities will feel larger than its measurements, and the calendar space it returns—those quiet Tuesday afternoons—often matters more than any extra closet.

The Emotional Side: Moving, Memory, and Adjustment

Homes are story keepers. Pencil marks on a door frame, the creak on the third stair, the window where the morning light first hits the table—these details weave place into memory. That is why even a rational decision to downsize can stir complicated feelings. You may feel pride at simplifying, grief at letting go, worry about belonging somewhere new, or relief at stepping out from under a long to-do list. All of those reactions are valid. Treat them as part of the process, not as red lights.

Begin with meaning, then sort the matter. When you approach belongings, ask three questions: Does this item serve me now? Does it carry a story I want to keep alive? Could someone else use it more than I do? From there, try a “keep, display, digitize, release” approach. Keep items that enrich daily life; display a smaller number where you’ll actually see them; digitize photos, letters, and children’s art; release duplicates, seldom-used tools, and things that whisper guilt. Invite family to claim items, then set a firm date for donations.

Transitions go easier with rituals. Give your home a “farewell tour,” room by room, naming a favorite memory. Write a short note to the next occupants about what the house does well—how the backyard catches the evening breeze or the front step is perfect for a cup of tea. Small ceremonies help close one chapter and open the next. When you arrive, set up comfort zones first: a good reading chair, the kettle, the lamp you love. Establish rhythm quickly: morning walk route, library card, market day, neighbor hello. Loneliness often yields to routine.

Social roots take intention. Schedule coffees with new neighbors, join a club that meets within walking distance, volunteer for a weekly shift. Use proximity as a catalyst: if a park is three blocks away, make it your afternoon loop. Acknowledge that identity will shift too. You might feel like a “guest” in a new condo or cottage at first. Give it ninety days of ordinary living before judging the move. Home is less about walls than about the rituals you tuck inside them, and those rituals need time to find their corners.

Putting It All Together: A Practical Path and Closing Thoughts

Start with clarity, not listings. Write down what you want daily life to look like, then design housing around that. A simple decision framework can prevent detours:

– Needs audit: mobility, stairs tolerance, storage, workspace, guest needs

– Budget map: fixed income sources, cushion for repairs, target monthly housing spend

– Location test: 10-minute access to groceries, care, parks, and transit

– Time valuation: hours per week you want to reclaim from cleaning and maintenance

– Risk review: weather, insurance, property tax trajectory, association rules

Next, price out two or three realistic scenarios. Include purchase or rent costs, estimated taxes, insurance, utilities, and either maintenance or community fees. Add moving costs (local moves can run into the low thousands; long-distance can be several times that) and a small reserve for furnishings or minor modifications such as grab bars and lighting. Compare a “stay and modify” option as well: the cost of retrofitting for single-level living, hiring seasonal help, and increasing delivery services. Sometimes the math favors staying; sometimes the compounding of smaller savings and time returns favor a move.

Plan your timeline in stages. Give yourself months, not weeks, for rightsizing. Work in short, consistent sessions rather than weekend marathons. Consider a trial stay in the new area via a short-term rental to test noise, light, and traffic at different times of day. Assemble a support bench: a licensed real estate agent who understands your market, a fee-only planner for tax and cash flow questions, and a move manager if the logistics feel heavy. Keep decision power in your hands by setting clear goals and communicating them early to family and helpers.

As you reach your conclusion, hold onto the “why.” You’re not chasing a trend; you’re shaping a season of life. A smaller home can mean bigger days: less time coordinating repairs, more time walking under trees; fewer “shoulds,” more “want to.” If the move aligns with your values, numbers, and health, it’s a strong step. If it doesn’t, adjust the plan until it does. Either way, you’ll have done the work to choose deliberately, and that’s worth a great deal. May your next set of keys open to sunlight on the floor, neighbors you know by name, and a calendar that finally breathes.