Candlestick Charts: A Comprehensive Guide for Beginners

Introduction to Candlestick Charts

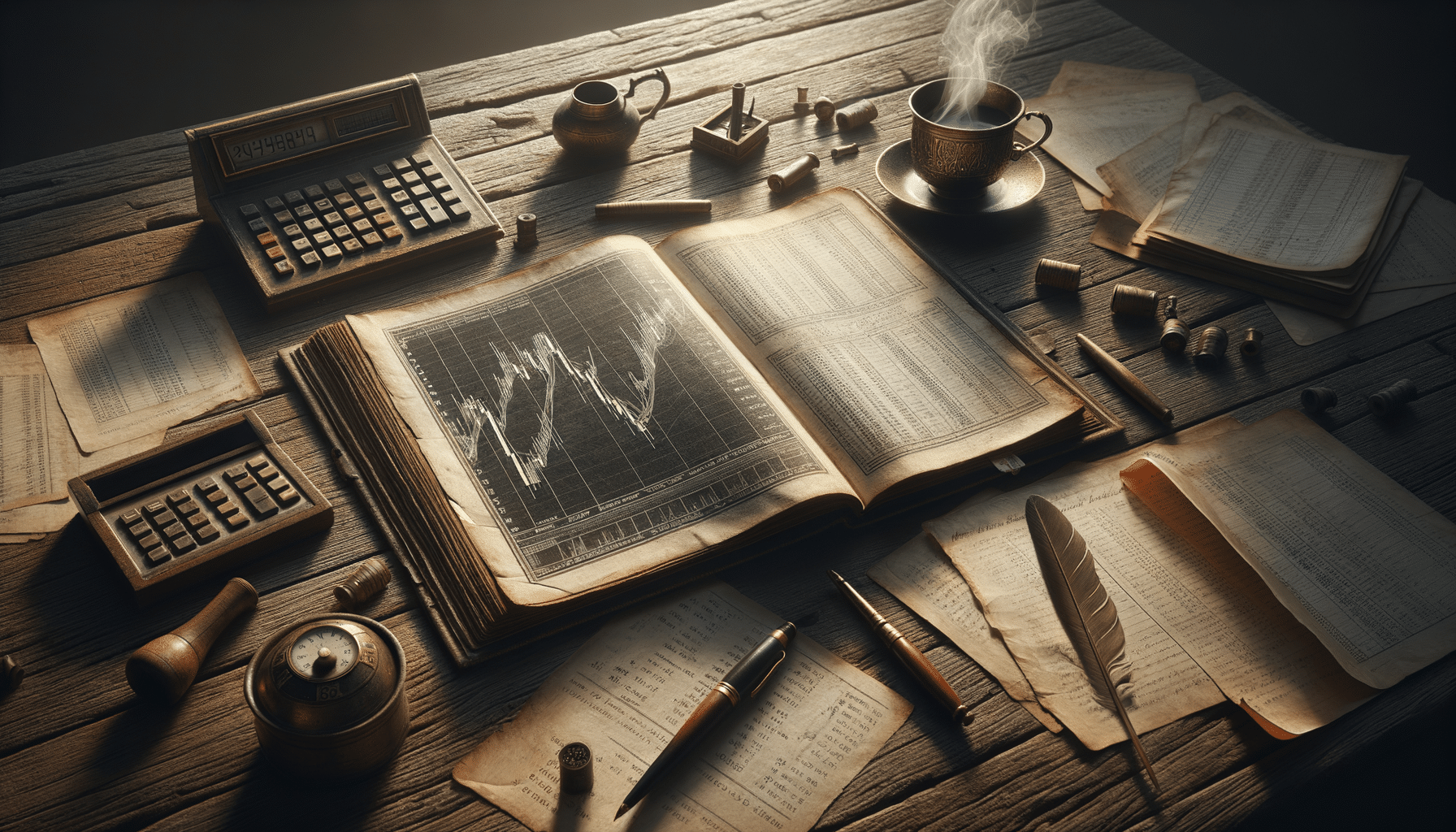

Candlestick charts have long been a staple in the toolkit of traders and investors, offering a visual representation of price movements over a specific period. Originating from Japan in the 18th century, these charts have become an essential tool for analyzing financial markets. They provide a detailed view of market trends and potential price movements, making them invaluable for both beginners and seasoned traders.

At their core, candlestick charts display the open, high, low, and close prices of an asset for a given time frame. Each candlestick consists of a body and wicks, or shadows, which represent the highest and lowest prices reached during the period. The color of the body indicates whether the asset’s price increased or decreased, with green or white typically signifying a rise and red or black indicating a fall.

The simplicity and depth of candlestick charts make them a popular choice among traders. They not only reveal price movements but also provide insights into market psychology, reflecting the emotions and decisions of market participants. As we delve deeper into the world of candlestick patterns and their interpretations, you’ll discover how these charts can enhance your trading strategies and decision-making processes.

Understanding Basic Candlestick Patterns

Candlestick patterns are formed by one or more candlesticks and are used to predict future price movements. Understanding these patterns is crucial for anyone looking to master technical analysis. Some of the most fundamental patterns include the Doji, Hammer, and Engulfing patterns.

The Doji is a candlestick pattern that indicates indecision in the market. It forms when the open and close prices are virtually equal, resulting in a cross-like appearance. This pattern suggests that the market is in a state of equilibrium, with neither buyers nor sellers having a distinct advantage.

The Hammer pattern is characterized by a small body at the upper end of the trading range and a long lower wick. It typically forms at the bottom of a downtrend and signals a potential reversal. The long lower wick indicates that sellers pushed prices lower, but buyers ultimately regained control, suggesting a shift in momentum.

Engulfing patterns consist of two candlesticks, where the second candle completely engulfs the body of the first. A Bullish Engulfing pattern occurs at the end of a downtrend and signals a potential reversal to the upside, while a Bearish Engulfing pattern indicates a possible reversal to the downside at the end of an uptrend.

These patterns, among others, provide valuable insights into market sentiment and can help traders make informed decisions. By recognizing and interpreting these patterns, traders can better anticipate price movements and enhance their trading strategies.

How Market Psychology Manifests in Candlestick Movements

Candlestick movements are a reflection of the underlying market psychology, capturing the emotions and behaviors of traders. Market psychology plays a crucial role in driving price movements, as it influences how traders perceive and react to market conditions.

For instance, a series of bullish candlesticks may indicate growing optimism and confidence among traders, suggesting an upward trend. Conversely, a succession of bearish candlesticks could signal increasing pessimism and fear, pointing to a downward trend. These emotional responses are often driven by external factors such as economic news, geopolitical events, or changes in market fundamentals.

Understanding market psychology is essential for interpreting candlestick patterns accurately. Traders who can identify shifts in sentiment and anticipate how these changes will impact price movements can gain a competitive edge. By analyzing candlestick patterns in conjunction with other technical indicators, traders can develop a more comprehensive view of market dynamics and improve their decision-making processes.

Moreover, recognizing the psychological aspects of trading can help traders manage their emotions and avoid common pitfalls such as overtrading or holding onto losing positions. By staying attuned to market psychology, traders can enhance their ability to navigate the complexities of financial markets and achieve greater success.

Advanced Candlestick Patterns and Their Implications

Beyond the basic patterns, there are numerous advanced candlestick formations that offer deeper insights into market trends and potential reversals. These patterns are more complex and require a nuanced understanding of market dynamics to interpret effectively.

One such pattern is the Morning Star, which is a bullish reversal pattern that occurs at the end of a downtrend. It consists of three candlesticks: a long bearish candle, a small-bodied candle (the star), and a long bullish candle. This formation suggests that the selling pressure is waning and a new uptrend may be emerging.

Another advanced pattern is the Evening Star, the bearish counterpart to the Morning Star. It appears at the end of an uptrend and signals a potential reversal to the downside. Like the Morning Star, it comprises three candlesticks: a long bullish candle, a small-bodied star, and a long bearish candle.

The Three Black Crows pattern is another notable formation, consisting of three consecutive long bearish candles. This pattern suggests a strong reversal from a bullish trend to a bearish one, indicating that sellers are gaining control over the market.

By studying advanced candlestick patterns, traders can refine their analytical skills and enhance their ability to predict market movements. These patterns provide valuable clues about the underlying market sentiment and can be instrumental in developing robust trading strategies.

Conclusion: Harnessing the Power of Candlestick Charts

Candlestick charts are a powerful tool for traders and investors, offering a wealth of information about market trends and sentiment. By understanding the intricacies of candlestick patterns and the psychology that drives price movements, traders can make more informed decisions and improve their trading outcomes.

Whether you’re a novice trader or an experienced investor, mastering candlestick charts can provide a significant advantage in navigating the complexities of financial markets. By combining candlestick analysis with other technical and fundamental indicators, you can develop a comprehensive trading strategy that aligns with your goals and risk tolerance.

As you continue to explore the world of candlestick charts, remember that practice and patience are key. By honing your skills and staying attuned to market psychology, you can unlock the full potential of this invaluable analytical tool and achieve greater success in your trading endeavors.